You’re going to pay waaaaaay more in interest on a house than a vehicle. I don’t mind going the life of a loan if I’m keeping the car. Things are going the shit way with rates now but back when they were nothing, I’d rather end up paying a few grand extra to borrow 20-30k vs dropping all that money on a car. Such a drop in the bucket compared to paying $1500 or whatever for a mortgage and seeing $400 go towards principal.

Install the TCG app

how_to_install_app_on_ios

follow_along_with_video_below_to_see_how_to_install_our_site_as_web_app

Note: this_feature_currently_requires_accessing_site_using_safari

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

More options

Who Replied?I’ve been doing this with great success since I got divorced and had to get rid of my nice car and payment.To point out, the financial celebrity gurus do not tell the whole story.

The, buy a $5k - $7k vehicle, to reduce debt is not 100% accurate as the vehicle will likely need $3k or more of work within a year or so.

Unicorns may occur, but even an old reliable 4 cylinder Accord / Camry will need frequent maintenance / repairs.

Find a good deal, fix up a couple of things, drive for a year or two then sell for even more than I paid, it can be done you just have to be smart.

GLADIATOR let us know how much of your mortgage payment goes towards principal. Even a well established loan it still hurts to see.

On a 30 year mortgage it’s messed up what goes to principle and how much interest is paid at the end.

You can still find rates around 3% at TFCU.Everyone’s situation is different. We live in a manner that can be barely sustained on just my wife’s income, and if I work all year I make more than she does. If interest rates were low I’d leave the slush fund alone, but they are not. I don’t want to pay 6+% interest over 5 years if we don’t have to.

My rate was not great. So shorter term lower rate. And my personal want to pay it early. I have no credit. We rent, I have had no car payments for 7 years and no credit card.As mentioned in the home thread I can't even be on the mortgage when we buy our house because I'm a credit ghost.

On a 30 year mortgage it’s messed up what goes to principle and how much interest is paid at the end.

It’s criminal.

Seems the $100k or less remaining on the loan is the fine line for the amount going to interest being somewhat tolerable.

Here you go

GLADIATOR you never worry about paying off a vehicle sign and drive on a 10 year loan with zero down

GLADIATOR you never worry about paying off a vehicle sign and drive on a 10 year loan with zero down

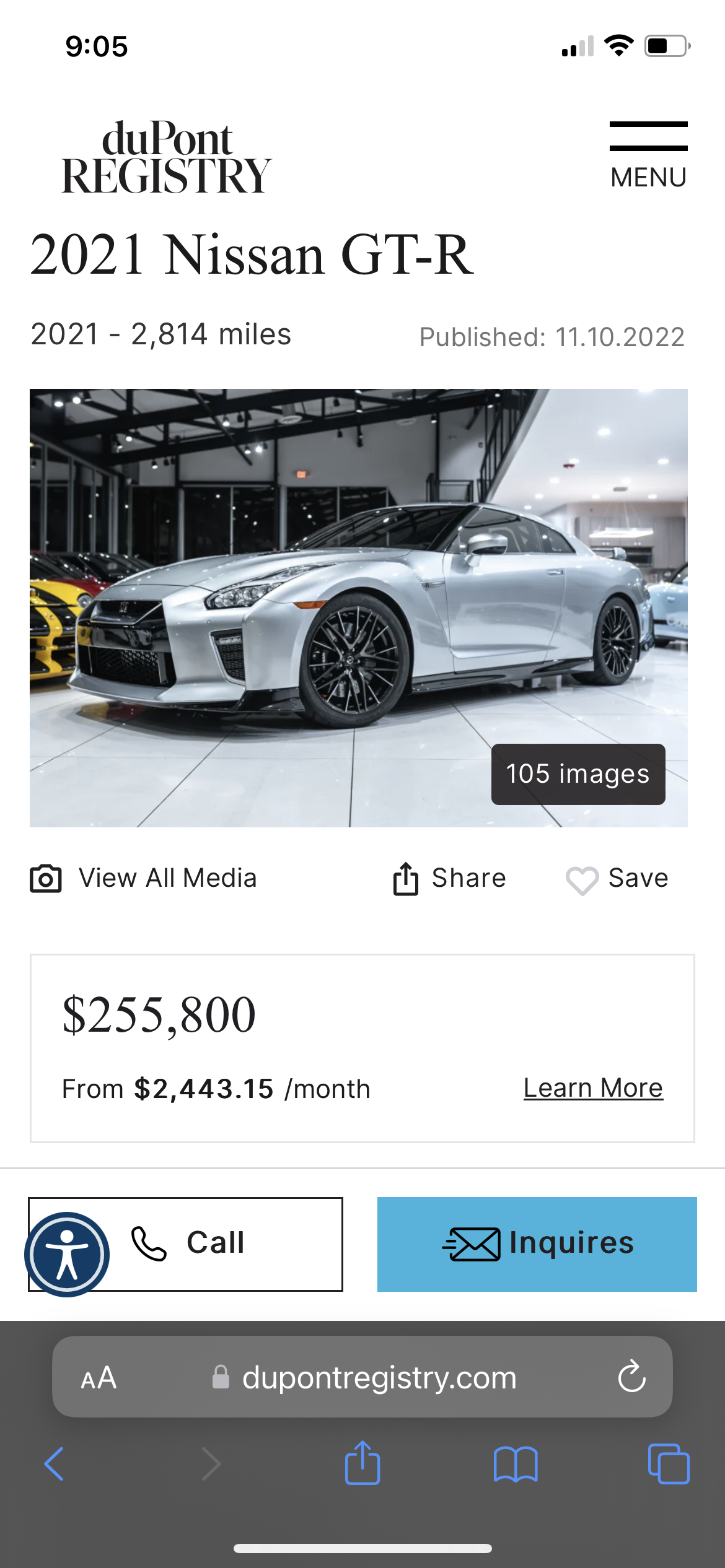

215k in mods

2021 Nissan GT-R For Sale

Buy this 2021 Nissan GT-R For Sale on duPont REGISTRY. Click to view Photos, Price, Specs and learn more about this 2021 Nissan GT-R For Sale.

www.dupontregistry.com

215k in mods

After I lost my job i bought It to be a daily driver that got great MPG. I drove it for 175k miles and wore it out. I was doing the right financial thing and got stuck with a car worth $1k. That car was 0% interest.You seem angry? I agree VW jetta was a bad ass ride

Tell that to all the people that got fucked when the real estate market crashed.I’m still laughing why would you want to pay your house off you say? Hmm have no mortgage and not pay all that juice. The equity you plan on having you can have more if you pay it off and in the meanwhile be mortgage free and save more money for when you retire. OR If your were mortgage free you can stop window shopping and drive your demon while you are still alive.

I could buy a Demon, a notch, and a pro street camaro and still have money left for the price of thatHere you goGLADIATOR you never worry about paying off a vehicle sign and drive on a 10 year loan with zero down

2021 Nissan GT-R For Sale

Buy this 2021 Nissan GT-R For Sale on duPont REGISTRY. Click to view Photos, Price, Specs and learn more about this 2021 Nissan GT-R For Sale.www.dupontregistry.com

View attachment 146603

View attachment 146604

215k in mods

I am as broke and average as they are. My wife was in a major accident and we were forced to buy a vehicle at the worst time with prices soaring. I got 3.5% on my used 2018 explorer for more than 5 years. You can get lower interest rates at the dealers if you know how to negotiate them.Everyone’s situation is different. We live in a manner that can be barely sustained on just my wife’s income, and if I work all year I make more than she does. If interest rates were low I’d leave the slush fund alone, but they are not. I don’t want to pay 6+% interest over 5 years if we don’t have to.

When I lost my job, I sold my raptor, durango, FRS, and my notch pinky. So I could survive and have a roof over my families head.If or when you get laid off you can sell the vehicle.

I dont understand how you cant see paying interest is wasting money. Its worse on a vehicle but even having a mortgage sucks.

Paying interest is the price you pay to drive your vehicle. I for one don’t have the money to pay for a car or home for cash.

Of course I would rather live debt free. It ain’t happening.

Are your cars and house paid off?We know

I pay more in taxes than interest. True story.GLADIATOR let us know how much of your mortgage payment goes towards principal. Even a well established loan it still hurts to see.

This isn’t worth debating, it won’t go anywhere. Keep doing what you’ve been doing for 40 years while also complaining about being broke, just don’t offer bad advice to others because it helps you justify your own poor decisionsAre your cars and house paid off?

This isn’t worth debating, it won’t go anywhere. Keep doing what you’ve been doing for 40 years while also complaining about being broke, just don’t offer bad advice to others because it helps you justify your own poor decisions

It was more of a rhetorical question. Just trying to prove a point. Allegedly you are only financially smart if you have no car payment and no mortgage in some bizarro world. Since you are one of the most financially smart people I know, I wanted to see if you had a car note and mortgage. No debate necessary.This isn’t worth debating, it won’t go anywhere. Keep doing what you’ve been doing for 40 years while also complaining about being broke, just don’t offer bad advice to others because it helps you justify your own poor decisions

I have a 4.8% conventional mortgage (got kinda f’d on timing but it could have been a lot worse), a 0x72 loan on my suv that was a great overall purchase (under msrp and 0%), and an expensive lease on my wife’s 540i just because. Was a better deal than Audi or benz had but I have no illusions about how expensive it isIt was more of a rhetorical question. Just trying to prove a point. Allegedly you are only financially smart if you have no car payment and no mortgage in some bizarro world. Since you are one of the most financially smart people I know, I wanted to see if you had a car note and mortgage. No debate necessary.

I’ve always been willing to borrow the fuck out of money at low rates, but at >6% the game has changed and you should make a big DP or just not make the purchase. A $40k loan at 7%x60 is $7500 in interest total. That’s nuts.

0% 21 F150 0% 20 Mustang

2.6% on house

Everything over 5% is batshit crazy.

Id like a new car but not a chance in hell if int is over 5%

2.6% on house

Everything over 5% is batshit crazy.

Id like a new car but not a chance in hell if int is over 5%

I get it, I’ve been in situations where money is tight. Just saying paying down a mortgage is stupid because you’re selling it doesn’t make a lot of sense. With housing prices coming down that equity is falling AND you’re paying more interest if you’re not adding on to your principal every month or year. It’s a bigger dent than trying to pay down a car loan that’s a drop in the bucket of interest compared to even the best mortgage rates.It was more of a rhetorical question. Just trying to prove a point. Allegedly you are only financially smart if you have no car payment and no mortgage in some bizarro world. Since you are one of the most financially smart people I know, I wanted to see if you had a car note and mortgage. No debate necessary.

After I lost my job i bought It to be a daily driver that got great MPG. I drove it for 175k miles and wore it out. I was doing the right financial thing and got stuck with a car worth $1k. That car was 0% interest.

Tell that to all the people that got fucked when the real estate market crashed.

I could buy a Demon, a notch, and a pro street camaro and still have money left for the price of that

You are doing just fine keep at it.

I normally take the longest loan I can and pay it off as quick as possible, I like having the option to make a small payment if I need too, I’m not going to lock myself into a 1000 dollar a month payment if it could be 250, I might pay 1000 a month but I like the option not to if need be

To point out, the financial celebrity gurus do not tell the whole story.

The, buy a $5k - $7k vehicle, to reduce debt is not 100% accurate as the vehicle will likely need $3k or more of work within a year or so.

Unicorns may occur, but even an old reliable 4 cylinder Accord / Camry will need frequent maintenance / repairs.

i mean this can work pretty easily.

I’ve been doing this with great success since I got divorced and had to get rid of my nice car and payment.

Find a good deal, fix up a couple of things, drive for a year or two then sell for even more than I paid, it can be done you just have to be smart.

bingo.

will not happen with the navigator for me though..

Thread Info

-

466Replies

-

12KViews

-

Participants list