I wasn't planning on jumping into it any time soon. I just want to understand.

Install the TCG app

how_to_install_app_on_ios

follow_along_with_video_below_to_see_how_to_install_our_site_as_web_app

Note: this_feature_currently_requires_accessing_site_using_safari

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

More options

Who Replied?I’m good with it lmao. To be fair, I did sell a lot of mine in the .075 range last time it spiked, that’s what I bought into MVIS and some other stocks with.

Besides watching countless videos of all kinds on YouTube , here's one guy I subscribed to on YouTube and watch his videos. He goes in depth and sometimes you have to watch his videos a few times to really grasp the understanding. Keep in mind that he isn't the only guy I watch and learned from. I've also signed up for some courses that broke everything down and basically went over the stuff I've already knew but in a different way. Despite knowing a lot, I still learned some more with those courses I've bought. Also, with those courses, they do live trading and there's a few mods with various strategies and ways they trade (day, swing, long term, ect).I just mean what things like call options are and what it means trading them. Not actual companies to invest in.

The guy on YouTube that goes in depth:

In The Money Channel:

If you want me to really break some stuff down, then I can happily do that as well. Here's just some Terms and Definitions:

Assignment – An exercise by the seller that obligates the trader to sell (short call) or buy (short put) the underlying stock at the option price.

At the Money– When an option contract’s strike price is the same price as its underlying stock.

Break-Even– The price point where an option is neutral, no profit or loss when measured to expiration.

Credit– Cash received for the sale of an option.

Debit– The cost of purchasing an option.

Delta– The amount an option will change relative to the underlying stock changing.

Exercise– An option buyer’s right to demand shares or sell shares at any point prior to the expiration date.

Expiry/Expiration– The date the option contract reaches maturity, and the last day it may be traded.

Extrinsic– Any cost above the actual value.

Gamma– The amount the delta will change relative to the underlying stock changing.

Implied Volatility– A measure of current market condition.

In the Money– The point an option is profitable with theoretically closing at that moment. The price of the underlying stock has reached the strike price of the option contract.

Intrinsic Value– The actual value of the options current market price less the premium.

Out of the Money– Any point an option will incur a loss if theoretically closing at that moment. The price of the underlying stock has not reached the strike price of the option contract.

Spread– Buying one option and selling another at the same time in the same stock.

Strike– The price selected at which the stock will transact if the option is exercised.

Theta– The amount an option will change each day as the expiration date draws near.

Time decay– The option will decrease in value with no change to the stock as the expiration draws near. Another term for theta.

Underlying– The actual stock that the option is based on.

Volatility– The movement rate of a stock measured as a historical statistical probability.

Writing an Option– Selling an option.

If you'd like me to break some more stuff down then I can do so. I can throw up some more info if anybody would like.

i will go in and get just 10 shares to see whats up

In other news.... (MVIS)

There's currently (allegedly) chatter now.

There's currently (allegedly) chatter now.

i will go in and get just 10 shares to see whats up

in at 394

In other news.... (MVIS)

There's currently (allegedly) chatter now.

Definitely regretting selling out of DOGE. Even more so since I went in on MVIS with a lot of it and that is still tanking

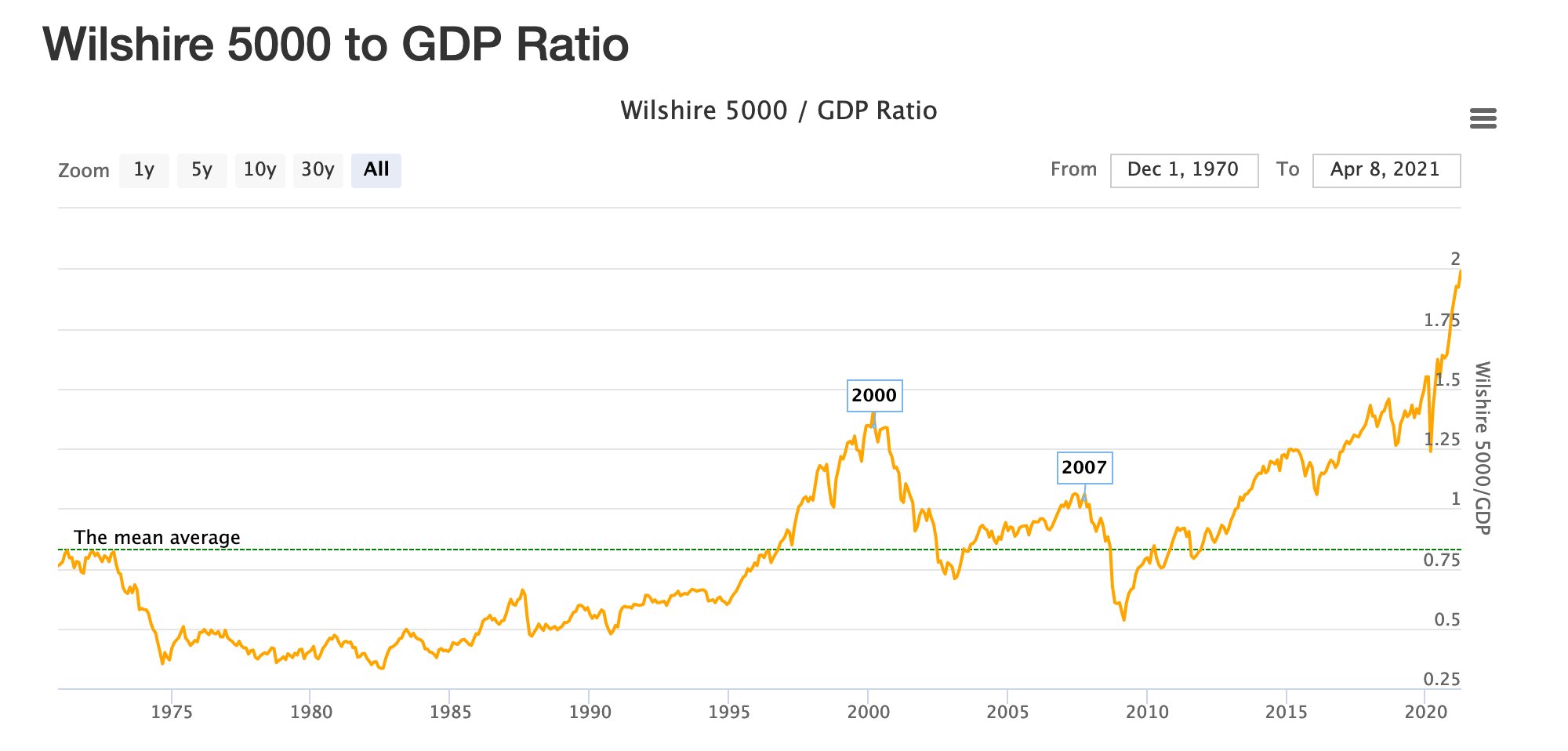

MVIS is being manipulated to hell. Shorting a lot to bring the price down, then big pockets buy long positions at the bottom. Also take into consideration that the monthly chart is finally "cooling" down with the indicators that were considered "overbought".

Here's something interesting to read and you do see A LOT of similarities with MVIS.

www.griproom.com

www.griproom.com

Here's something interesting to read and you do see A LOT of similarities with MVIS.

10 Signs Your Company is About to be Acquired — GripRoom

10 signs that your company is about to be bought out, or enter into a merger.

MVIS is being manipulated to hell. Shorting a lot to bring the price down, then big pockets buy long positions at the bottom. Also take into consideration that the monthly chart is finally "cooling" down with the indicators that were considered "overbought".

Here's something interesting to read and you do see A LOT of similarities with MVIS.

10 Signs Your Company is About to be Acquired — GripRoom

10 signs that your company is about to be bought out, or enter into a merger.www.griproom.com

Oh I'm having patience. Like I should have with Doge. Doesn't mean I'm not staring at Doge go to the moon without me.

I know the feeling! LolOh I'm having patience. Like I should have with Doge. Doesn't mean I'm not staring at Doge go to the moon without me.

Thread Info

-

2KReplies

-

40KViews

-

Participants list